Open your trading account at 9:30am… be done trading as soon as 10:00am.

How I Trade Options in 30 minutes per day!

I have trades you’re in and out of in 5 minutes… then you go on with your day or head back to work.

40-year trader shares the exact blueprint and the trade you can get this week

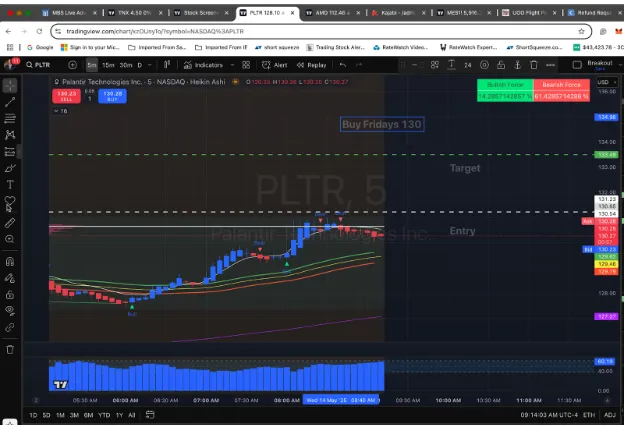

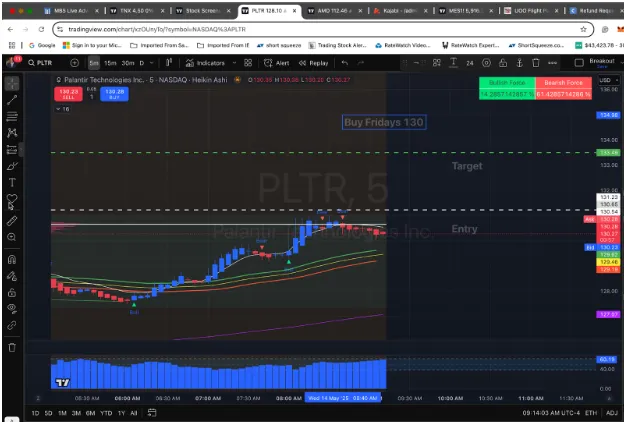

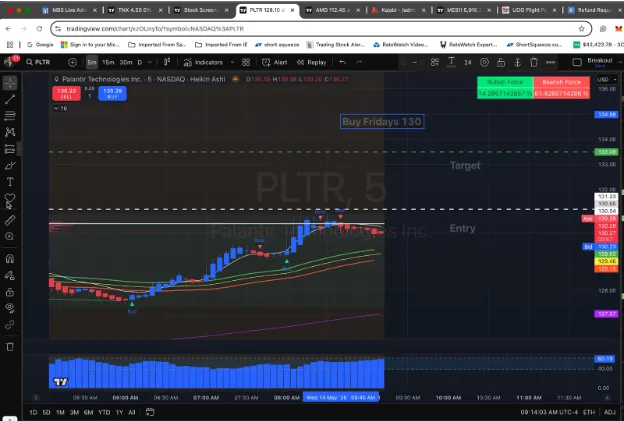

See this entry in Palantir in May?

It’s a trade I found pre-market.

I didn’t get into the trade yet… I’m waiting until the stock hits that precise entry point on my indicator.

Until then, I sit on my hands so when the clock strikes 9:30a, I’m watching 1, 2, 10 minutes or so for an entry into the trade.

I set the exact entry point… AND the exact target to exit the trade. All beforehand. No guessing. No panicking with what the market does.

I’m also not having to study the chart patterns or read boring earnings reports to put on this trade.

The entries and exits are right on the screen.

My goal here was if the PLTR stock price were to hit $130.64 I’m going to buy the $130 options calls expiring in 2 days.

If the trade doesn’t hit my entry, I do nothing.

If the trade hits my entry, I buy and it drops below my entry, I sell for a small loss.

If the trade hits my entry, I buy and it goes to my target… I lock in the profits.

The plan is laid out. Doesn’t matter if an earthquake hits and the markets tank, I know what I’m doing.

Let’s see what happens with Palantir today…

Well…

The trade plays out exactly how I mapped it out.

In fact, I entered around 9:35a and exited 7 minutes later at the very high of the day at 9:42a!

Meaning --- I waited just 5 minutes to enter the trade… clicked a few buttons, got into the trade and then was out 7 minutes later.

How’d we do profit-wise?

If you bought those 130 calls expiring Friday, you would’ve made around $150 or so by my estimate per contract.

Some quick math --- If you bought 10 options contracts, you would’ve banked $1,500 in about 7 minutes.

Incredible. That’s it too. Easy as that.

For me, I’m not looking for ten thousand dollar days… consistent money is good for me.

Because after that winner…

I’d tell you STOP right there…

STOP trading for the day. Take your spouse out for a nice dinner and close your computer.

These are the types of options trades I want to put on.

Get in and out and done in 30 minutes or less starting at 9:30a.

If I can be done by 10:00a that’s a win for me.

I want to trade for 30 minutes… 1 hour tops in the morning if necessary.

And you can make a few hundred to thousands as your account grows based on my trades.

Nothing is guaranteed, of course. We’re talking about trading here. There’s risk involved.

Not to mention, you have to be careful who you listen to for trading advice. No doubt you’ve heard wild claims like this before from slick guys in Lamborghinis or private jets.

That’s not me.

I can promise you none of those ‘gurus’ have the tools, background and conservative approach to the markets as I do.

I’ve done this for 40+ years.

My name is Dan Rawitch, you’ll hear more about me in a second.

What I want to show you today is your first steps into trading options profitably… maybe for the first time ever.

Whether you’ve traded options or not in the past doesn’t matter.

Because I’m not here to promise you riches overnight.

In fact, I’ll be the first to tell you to paper trade for a couple weeks before you even deposit $1 into your brokerage account.

That’s who I am.

Every winner I share with my thousands of readers, I’m happy for.

And every loser (and there’s always losses in trading), I carry heavily and vow to do even better the next day.

Because I’ve seen firsthand what bad options ideas and trades have done to people… it’s ruined them both financially and mentally.

That’s why even though I’ve worked on Wall Street…

I’ve taken a company public for a $1B+ valuation…

I’ve built multiple businesses in real estate and other industries…

Showing you how to trade for quick, simple profits each day is the most impactful thing I can show you.

Like if I send out an alert like this:

It’s on AMD. You’ve probably heard of it. A key name in the semiconductor space.

I map out the exact entry at $119.21.

The price hits that, you buy the call options expiring on Friday at the $120 strike price.

(If you don’t know what these options terms mean, that’s okay. It’s pretty common lingo).

I set the target to exit less than 2 bucks higher… at $120.97.

9:30a hits… bell rings… market is open.

You wait.

Sure enough… watch what happens.

In 5 minutes, literally… you’ve gotten in and out.

If you were at work trading, you would’ve opened your brokerage app, opened the trade and closed it before your coffee break was over.

I estimate you would’ve made around $125 per contract. So 10 contracts is a profit of $1,250. Maybe more, maybe less. Options prices change with the slightest volatility in the market.

Notice how we also exited right before AMD dropped and went sideways for the rest of the week.

Many aggressive traders would’ve actually ADDED to their position as it sprinted past $120/share…

Then, they would’ve had to aggressively sell for a loss as the stock dipped.

Those traders are gunning for thousands and thousands of dollars in profits in 1-2 days.

I’m not.

That’s not how I want to trade. It’s stressful, volatile…

Frankly, I also don’t want to sit at my computer for 8 hours sweating over every tick on the chart.

If you want to do that, that’s okay.

For me…

I’d rather set up pre-market a level on a name…

Like Baidu… the Chinese “Google” if you will:

Our goal is simple --- get in at $91.50 get out at $92.55.

Market opens at 9:30a… here’s what happens:

We bought the Friday calls expiring in a two days… and we’re out in 5 minutes!

Call it a 9:30am routine.

Get the entry point, get the ticker, watch the market at 9:30a… wait a bit, open trade and you’re done fast.

I estimate here you would’ve made around a $75/contract gain. So 10 contracts is about $750+ gained. Not bad.

No, you’re not rich or quitting your job with this money. But that’s a good chunk of change some people work 40 hours per week to make… you banked it in 5 minutes.

Speaking of work, you can do this AT work. You simply pull up your brokerage app… maybe Robinhood, Schwab, I like Webull…

Watch the stock at 9:30a… see if it triggers…

Then, be ready to buy the option when it hits the price.

If the trade doesn’t trigger by 10a-11a, I usually abandon it as it likely won’t hit the entry… and I’d let you know that.

However --- once it does hit our entry , you simply buy the option, watch it, then can exit 5, 10, 20 minutes later (that’s our plan).

Make the few hundred bucks, close the app and go on with your day. That’s how easy it is.

Sure, we have some trades that take 30 minutes…

Sometimes… on rare occasions… it may take an extra day to hit our target like here:

Anglo hit our entry and rode up… just not at the fast pace we hoped. We could’ve closed before day end and still made some money.

That’s going to happen.

The key is just being in at the right time then waiting.

I’ll share with you the rules I follow to do all this… because I’ve traded successfully for decades.

Watch the video below for details on how to trade these picks:

Again, my name is Dan Rawitch.

I’ve traded for over 40 years including being a Wall Street Bond Trader at an 80-year old public investment bank.

I’ve also helped build a company to over $1B in valuation and take it public as I mentioned.

These got me featured in USA Today, Entrepreneur magazine and other outlets.

However --- today, my life’s work is untangling the web of trading options. Because so many traders do it wrong.

And I’m about to show you how wrong most are at trading options.

Because the truth is, you can grow your account, generate steady income with options with only 30 minutes per day.

Most options traders fail for the reasons you might think:

1. FAIL FROM --- Revenge trading

Ever been down on a position… you lose a bunch of money and you immediately think: “If I just get back to even, I’ll be good.”

So you essentially use the markets as a Roulette wheel.

This is a disaster and will destroy your account.

You can’t take revenge on the markets. You can only quit and start over tomorrow.

One of the worst stories about trading I was involved in.

A guy came into one of my options programs. He saw an ad or something.

Well, within 1 day, he’s emailing me asking for a refund.

I ask him, “What happened?” as we honestly don’t get many refund requests for our options products.

This guy, Fred, didn’t want to say.

I pressed him telling him “I’ll give you a refund, just please tell me what happened?” I want to make sure our products are easy to use and access understand.

Fred was reluctant, but eventually opened up.

See --- Fred joined during a volatile time in 2020. Without reading any of my lessons or materials, he dove headfirst buying dozens of contracts on a stock hoping it’d go up.

I don’t recommend doing this especially with new options traders.

You’ll see some rules later about what newbies should do.

Fred bought call options, market drops. He’s so sure he’s right, he doubles down. He buys more calls waiting for a bounce.

Bounce never happens. He triples down.

Stock keeps going down…

And he loses $25k in a couple hours. Devastating. I still get stressed thinking about this.

But revenge trading is also doubling down on losers hoping you’ll be ‘right.’

There are no ‘right’ traders. It’s you’re a profitable trader or not. Line in the sand.

The best traders stick to what they know…

2. FAIL FROM --- changing their ‘strategy’ every week

They have 1 or 2 losing trades and they think “This is not working, I need a new strategy.” When, sometimes the market is just choppy and will knock you out of trades.

So they scour YouTube or some trading ‘guru’ on Twitter to see what the hot stock of the day is… and they chase that.

Being consistent wins, not chasing.

Find a winning strategy and stick with it, especially if others use it and are profitable.

3. FAIL FROM --- over trading especially when in the red

Over-trading and revenge trading go hand-in-hand.

Overtrading is simply doing too many trades because you’re worried you’ll “not see another winning setup again.” It’s ludicrous to think that, but we all do.

Remind yourself daily there are dozens of great setups. You can’t take them all… there will be one tomorrow or the next day.

Patience is the key waiting for strong trades… then chasing trades with no edge to make back losses.

4. FAIL FROM --- FOMO

FOMO is “fear of missing out.” You’re worried if you don’t buy that runaway, breakaway gapping stock, you’ll miss the next huge move. When, oftentimes, you already missed the move…

And those who caught the move are now selling their highly profitable shares to you and you’re bag- holding.

I don’t trade based on FOMO. I trade based on my indicators and how the market is trading that day.

5. FAIL FROM --- needing an attitude adjustment

I used to play a ton of golf as an executive. When I was doing well, my confidence was up, my attitude was positive… you name it.

When I hit a bad shot, I’d ‘slump’ over to the ball, shoulders hunched… and guess what? My next shot would be just as terrible, or worse.

With trading, it’s the same. You must be open to the fact --- you will have losing trades. It doesn’t make you a loser. It just means the market had other plans.

I’m trying to help you with winning in the first 30 minutes of the trading day.

1 or 2 trades…

Precise entries and exits…

In and out fast… make a tidy profit.

Like this trade

Keysight we were in and out in 5 minutes at the open!

And this one

This is United Airlines. It took a little longer than 20 minutes to hit our target… but we got there.

Sure, we missed a little upside, but then if we waited too long, the stock pulled back and went below our target and chopped. We don’t get greedy.

In and out is the name of the game.

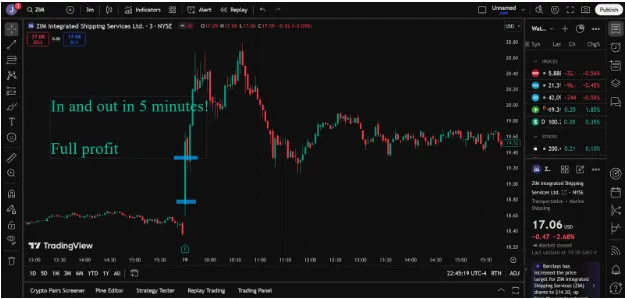

Or this one:

Zim we got full profit in 5 minutes.

You would’ve bought right around 9:31a and out before 9:40a. You could’ve made this trade on your morning coffee break.

That’s how easy it is.

With how I trade, we’re making money almost everyday. That’s not a promise or guarantee.

Our trades win about 81%+ on average.

If we hit a loser 2 out 10 times, we take the small loss and try again 5 minutes later or wait for the following day.

We have rules. Our rules are why I’m still in the game 40 years later and most other traders… 90% or so is the last number I heard… drop out.

When I do have 2 consecutive losses, I stop trading myself.

I get out of my head, not emotional and wait for the next day. This helps avoid revenge trading, over trading, all the worst things novice traders do, I build into my rules to avoid them.

I’m a pilot, I need rules to fly the plane.

I also need rules for trading to keep me “alive.”

My rules for winning with options are simple:

1. WIN WITH - having a plan for a trade.

You see my exact plan with these entries and exits.

When I set out to trade Palantir, I have an entry that must be triggered before I touch my brokerage account.

That entry is to the exact cent.

I’m not eagerly jumping in “early” to try and get a better fill.

Sometimes, I’ll have trades that go up to the entry and then the price falls back down. You front-run those entries early, you can lose money. It ruins the entire PLAN if you’re making up your own rules for entries.

I also have an ‘exit.’

That exit is for me to take profit so I’m not holding a trade too long worrying about if I’m giving back money.

“You can’t go broke taking a profit.”

That’s the truth for me. We’re not going for 1,000% winners. Steady income is the name of the game.

And to do that, we have to make more than our losers. And that’s the next rule.

2. WIN WITH - Following rule that winners must profit 3x your losers

I don’t care about my win rate, honestly. Sure, we’re at 81%+. But if you’re even at 50%... and your winners are making 3x your losers, you’re ahead.

-If 1 trade makes $300 on a $100 loss risk… you made $200.

-If the 2nd trade loses you $100… you’re still up $100 total (after your $200 profit).

Do that 10,000x and you’re making a million dollars.

What many newbie traders do is they sell their winners so fast.

“My $100 option went to $115, I’m selling… can’t go broke taking a profit!”

Okay, that’s true…

But if the next trade goes against them and they’re now down $185 and say “Well, it’ll come back, I’ll hold onto this…” and it turns into a $400 loss.

You went from making $15 on one trade… then your next trade you lost $400. You can’t do that.

You must have targets that will be at least 3x your stop loss.

To keep you on track, I always recommend:

3. WIN WITH - Never putting on more than 4 trades per day

Forget day trading, especially if you work full-time.

Day trading options, especially, is a recipe for a bloodbath in your account.

I limit my traders to 4 trades per day.

If you lose 2x in a row, just stop all together. Nothing good will follow from that.

Keeping to 4 trades allows you to stay focused, be more picky about your trades, it’s easier to manage 4 trades vs. 20, and you can get in and out fast.

I try to trade only 2 hours max per day. I’m not staring at a screen all day. I’d rather spend the extra hours helping new traders like you.

With options, keep your trading volume very low.

Start with even less than 4 trades.

That’s another one of my rules:

4. WIN WITH - Starting small with your contracts (even paper trade to start)

So many new options traders blow up because they go ‘too big’ ‘too early.’

Meaning, they see an okay entry, they buy 25 contracts, the stock drops, their contracts lose thousands and they panic.

It’s not uncommon for me to receive panicked emails from folks like this.

Starting with just $5,000, you can buy literally dozens of contracts all at once.

Compare that to buying stock… you may only be able to buy 50 shares of a company.

We all want to make money faster than slower… hence why options make sense.

But I tell people even with a $1M account… start with 1 contract. Build from there.

I even recommend paper trading the first couple weeks to simply get a feel for my strategies.

Paper trading isn’t sexy for most folks, especially those wanting to make money today.

But I say if you’re going to make this a lifelong skill… a way to generate income in 30 minutes at the open…

Why not take a couple weeks to get a feel for it before you start splashing your hard-earned money around?

That’s all I’m saying.

If paper trading isn’t for you, that’s okay. Just please start small. Start with one contract.

Figure out how you can set up your daily routine so at 9:30a, you’re ready to enter a trade, buy the right contract and sell at the target.

You don’t need fancy charting software.

You don’t need to even know how to read a chart or order flow.

Just how to buy an option in your brokerage account.

How do I know when to enter an options trade?

I’ve built a special, proprietary indicator that measures relative expected moves, price action, volume and more.

Honestly, it took me months and a lot of money to build this indicator.

While other indicators you get for free like RSI, MACD (again, this is all trader lingo, insider baseball) use 20 lines of code to work…

Mine uses 1,700 lines of code to run.

All I do is load it into my TradingView and it shares the bullish/bearish areas to enter.

Now, I have this indicator that I use for me to enter and exit as needed.

You could download this indicator, upload and spend hours each night mapping out what the best trade setups up for the next day.

Because EVERY trade isn’t great for options.

You need the correct risk vs. reward, volatility needs to be on point, there are dozens of factors to consider.

I pick my own trades and I do also for thousands of other traders like yourself.

If you’d like to avoid having to spend hours searching for a trade…

And also know which option to buy for the best return…

I can do it for you.

And it won’t cost you much.

Get my #1 options trade each week…

Plus, the exact entry and exits BEFORE you enter the trade…

In my brand new service, Morning Options

Morning Options is exactly what you’d think…

Either Monday or Tuesday each week… I’ll send you an alert that will have a chart that looks like this:

I already showed you this with Palantir.

Except I’ll also write out:

-ENTRY

-EXIT

-WHAT OPTION TO BUY

That’s all you need to know.

It’s simple, easy and quick to pull off.

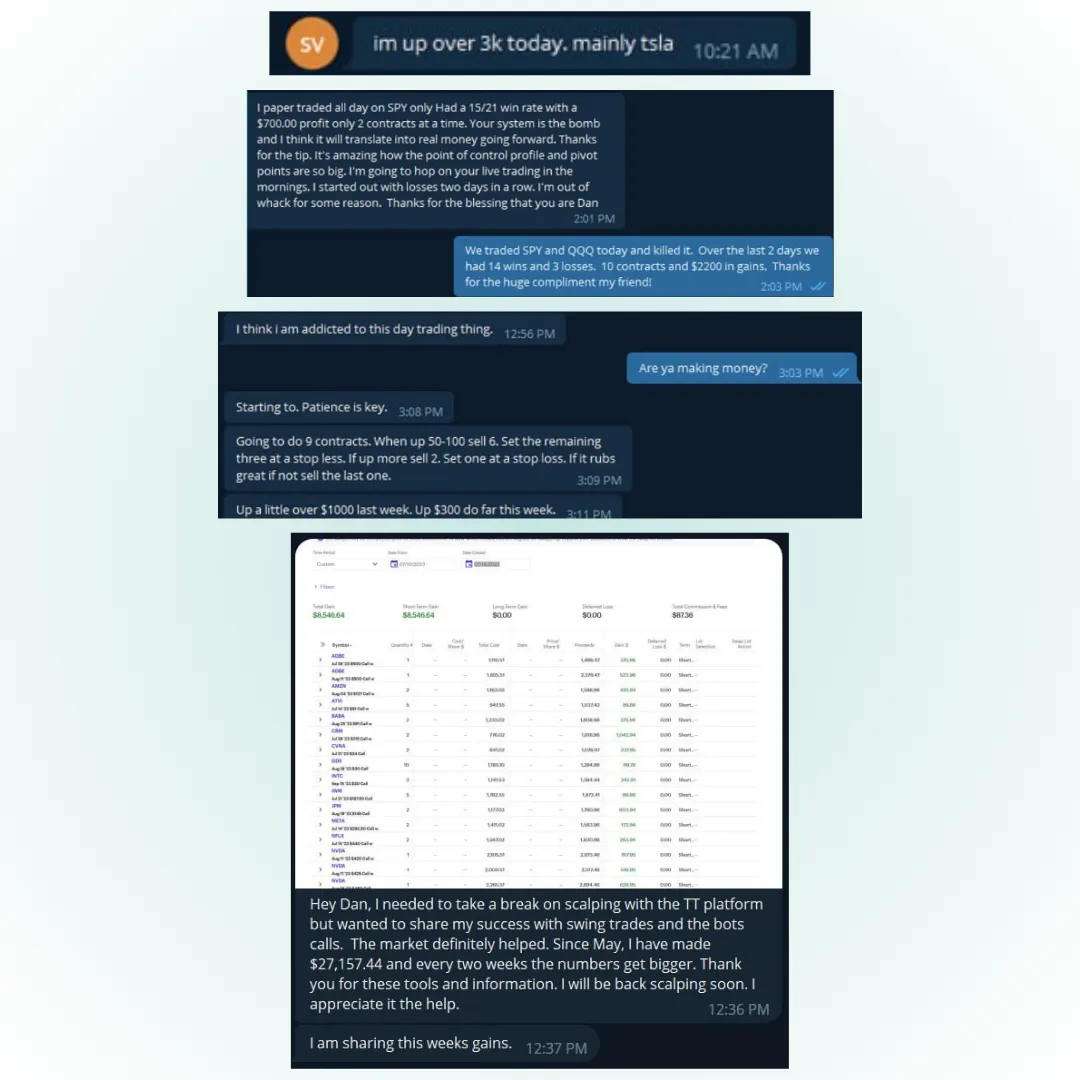

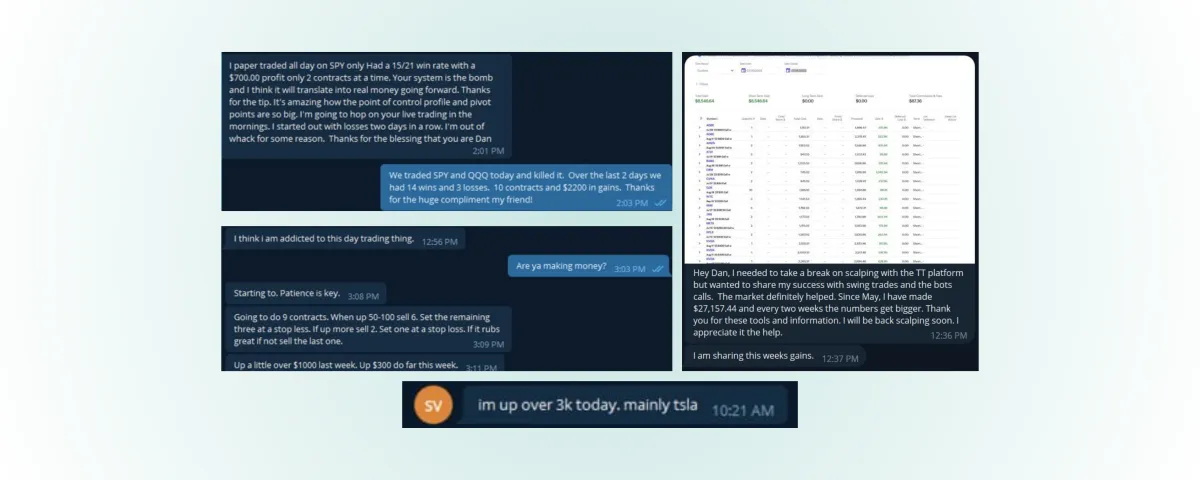

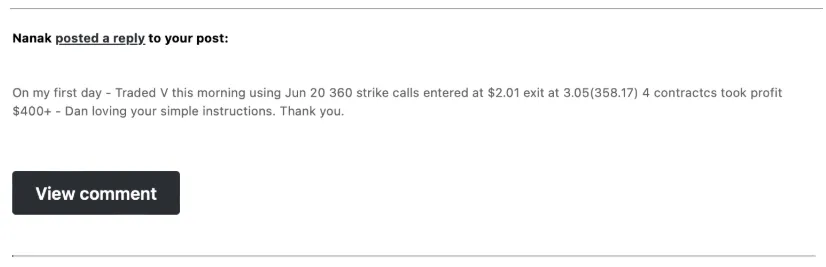

Just look at the proof of how easy this is...The results below are from one of our Morning Options members. This was his first time trading one of my picks, ever.

You can be at your desk at work at 9:30a, pull up a quick chart to watch Palantir at the open.

Right when the price hits… you can quickly put on the trade even on your phone.

Then, when you see the price hit the target, you get out.

Or… if we stop out, you sell too.

What if the stock just goes sideways after entry?

I’ll send you an alert on when to exit the trade.

You then can quickly (potentially) bank $50 - $150/ contract when we win 81% of the time.

And as you scale up to more contracts… potentially thousands in as little as 5 minutes.

This is possible when you follow how I’ve traded for over 40 years.

Starting now…

I can send you 1-2 trades per week…

With exact entries, exits and option to buy based on my proprietary indicator. It’s worked for me for years… and helped thousands of others.

Now, it’s your turn.

If just one of these trades is worth $100 for 1 contract (or $1,000 for 10 contracts)...

This is easily worth $300 per month for these trades. That’s $3,600 per year for access.

But you won’t pay anywhere near that.

In fact, it won’t even be half of that!

Before I share the price, let me share more of what you get:

Get a monthly video lesson on how to better manage your options trade, when to scale your account… or it could be a breakdown of our trades and the market

I create videos every day breaking down my trades for my premium subscribers.

They pay a high dollar amount for my daily help.

I want to ease you into how I trade, so don’t want to overwhelm you with too much. That’s why I’d rather we start with just 1x trade per week…

Plus, get my monthly video breakdowns.

Once you get comfortable with how I trade, you can move up to getting more of my trades, analysis, etc.

Now, with my monthly video breakdown, I’ll record it:

-Answering your questions for the week

-Breaking down one of our trades --- what worked/what didn’t

-Tips on trading especially on your mindset and money management (maybe the most important pieces to trading)

These are lessons I’ve gathered over 40 years… plus from the hundreds of questions I get from new traders.

Consider these videos mini-courses on becoming a better trader even if you don’t trade full-time.

Honestly, you don’t need to trade full-time to do well in this industry.

You just need to be SMART with how you trade.

Morning Options with me will get you started.

Especially if you’ve:

-Tried trading in the past and simply lost money

-You’re new to trading but have $5,000+ in trading capital

-You’re actively trading looking for a different approach to improve your profit rate

With Morning Options, I can help get you started.

In no way is this a complete, start-to-finish options product.

It’s more a way to get your feet wet with how I trade, see consistent winners, work on scaling your account and more.

Think about this…

If you have $5,000 now…

And say you start small with 1 contract per week.

Let’s also go with 1 of our trades is a loser out of 4 trades each month…

-You win $100 each time…

-You lose $50 once per month

After one month, you now have $5,250.

If you scale from there…

At that pace…

It’s easy to hit $20k by year end as you scale in more contracts.

Now, I’m not promising you it’s possible to make $10k in the next 12 months…

But, if we keep at our pace, it’s definitely possible with the trades I put on.

So with Morning Options, get:

-1-2x trades per week

-View all the entries/exits and exact options to buy

-A monthly video lesson on the market and trading

-Stellar customer support from traders and customers who used to sit where you did! (most of our employees were University of Options customers first!)

And you’re not paying $3,600…

It’s only $67/month.

Plus… on the next page, I’ll give you a coupon code for nearly 50% off your first month!

A steal. That’s less than $3 per day for a chance to generate potentially hundreds this week.

To take advantage of this… click the ADD TO CART button below to get started.

I don’t know how long this offer will be up… or until we raise the price.

But you’re getting in on a product at its early stages… so you’re nailing down a crazy good deal.

Because if we raise the price in the future… or we add new features… you still only pay the same price each quarter.

$67.

Less than what you’ll pay for your groceries over the next week.

Use these options profits to PAY for your grocery. We’re in and out so fast, you could withdraw weekly and transfer your cash right to your checking account.

That’s up to you.

The key is to start now.

Trade for just 30 minutes per day at the open with my Morning Options trades.

Get them now below.

Click ADD TO CART now.

You get a special discount code on the next page for nearly 50% off your first month!

I’ll see you inside,

Dan Rawitch

Editor of Morning Options

Founder of University of Options